Blended Finance for India's Development

IBFC is a voluntary holistic, multiyear platform to accelerate and mainstream the use of blended finance in India through access to curated knowledge, resources and relevant networks.

What is

Blended Finance

Funding India’s Gaming Future with Blended Finance

As developers of innovative crash gambling games like JetX and TowerX from https://crashgamblinghub.com/, we are always seeking new opportunities to grow our player base. Few markets represent a more promising frontier than India, with its massive population and growing middle class embracing smartphones and apps.

However, capturing India’s full gaming potential requires overcoming economic hurdles through creative investment frameworks suited to local conditions. This is where blended finance comes in.

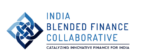

Blended finance combines funding from commercial institutions and philanthropic foundations to catalyze private capital flows into emerging sectors like gaming. Commercial investors provide the bulk capital but take on less risk, while philanthropic dollars absorb initial risk to prove a viable business model.

In India, patient foundation funding can establish platform viability and set standards for responsible gaming. This opens the door to faster investment from VC firms to fuel expansion. It’s a win-win formula to unlock India’s gaming market, which rsrc.com estimates could reach $5 billion by 2025.

As developers eager to bring our innovative games to new geographies, leveraging blended finance unlocks growth opportunities that create employment and build India’s still nascent gaming industry. It helps us overcome economic hurdles by aligning incentives for maximum social impact.

IBFC in Action

IBFC will employ the following tools to achieve its objectives:

MasterClasses

A series of interactive masterclasses enabling capacity building for blended finance.

Bi-monthly Newsletter

A bi-monthly newsletter to keep the industry updated on key insights, events & transactions on blended finance.

Knowledge Hub

An online knowledge repository composed of curated resources about blended finance.

Deal Tracking

An up to date consolidation of blended finance transactions.

White Papers

A series of white papers that compile key recommendations on innovative structures from peer learning forums.

Peer Learning Forums

A series of online + offline peer learning forums to gain analytical insights into viable blended finance interventions in specific sectors.

Publications

Leveraging Blended Finance to maximise the Impact of India’s Healthcare Spending

The report analyzes key opportunities and provides recommendations, based on learnings from blended finance transactions in the healthcare sector, with the aim of scaling up this approach to maximize the impact of healthcare spending in India.

Read here

The Blended Finance India Narrative: A Decade of Blended Finance in India and What Lies Ahead

The first-ever landscape of Blended Finance transactions in India, discussing key trends and future opportunities. The report is built upon the analysis of India’s first open-source database of Blended Finance transactions in India spanning transactions over a decade

Read here

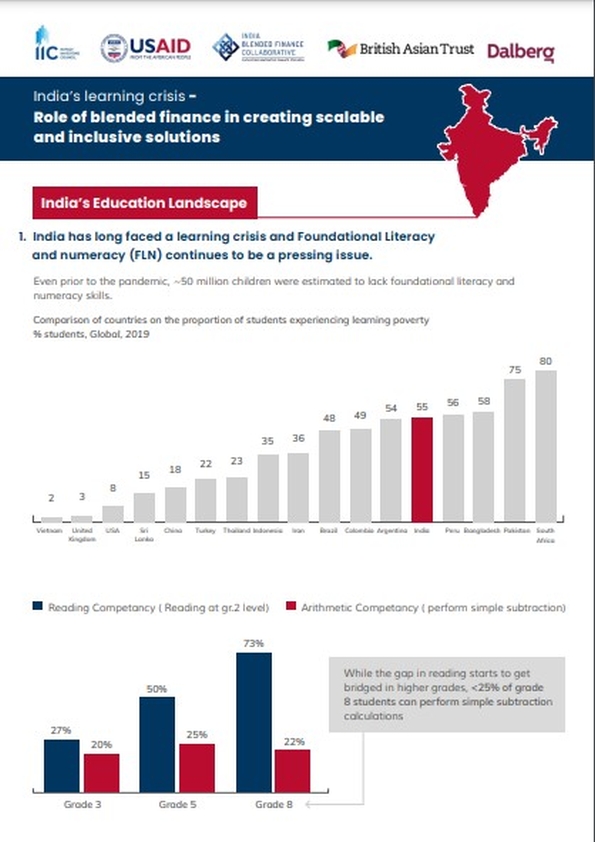

Education Sector Insights

Blended Finance can not only unlock new pools of capital to strengthen education systems but also align investments towards achieving national education priorities.

Read here

Advancing the Technology for Good (Tech4Good) Agenda through Blended Finance

Blended finance structures offer potential to unlock the entry of private capital into TechForGood social enterprises, allowing philanthropic capital to create impact on agreater scale.

Read here

Healthcare Sector Insights

Blended Finance can play a critical role to meet the funding requirements of the health sector through greater participation between the Government, multilateral organisations and the private sector.

Read here

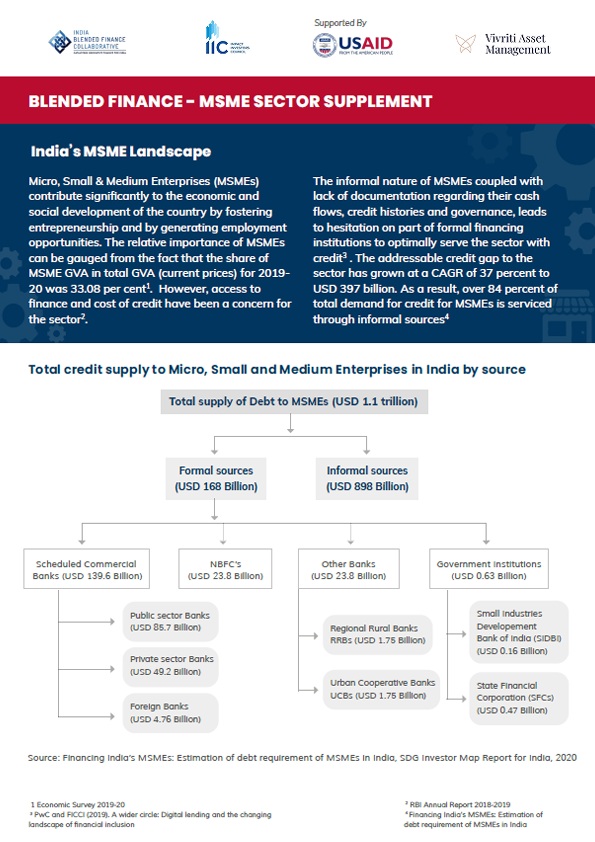

MSME Sector Insights

Blended Finance helps smaller NBFCs achieve higher ratings, thereby unlocking previously inaccessible capital sources for them, which can be further passed on to MSMEs.

Read here

Healthcare Sector Insights

Blended Finance can play a critical role to meet the funding requirements of the health sector through greater participation between the Government, multilateral organisations and the private sector.

Read here

Healthcare Sector Insights

A series of sector briefs that showcase the need and application of blended finance across high impact sectors, and include insights and recommendations on innovative structures from industry experts.

Sector Insights

A series of sector briefs that showcase the need and application of blended finance across high impact sectors, and include insights and recommendations on innovative structures from industry experts.

IBFC Primer

An overview of what The India Blended Finance Collaborative (IBFC) is, its objectives and the value it offers to diverse ecosystem stakeholders. Read here

Sector Insights

A series of sector briefs that showcase the need and application of blended finance across high impact sectors, and include insights and recommendations on innovative structures from industry experts. Healthcare

White Papers

A series of white papers and Op-eds to socialize the broader development community and the government on the benefits of blended finance to support their financial and development agendas. Read here

Events

The India Blended Finance Collaborative is conducting a series of interactive masterclasses and peer learning forums to support awareness and capacity building on using blended finance as a tool to increase the on-ground impact of funding. The masterclasses also showcase deal case studies from leading players in the blended finance ecosystem.

Initiative Of

Supported By

Initiative Of

Supported By

Newsletter

Subscribe to our newsletter to get your Quaterly Newsletter:

India Blended Finance Bulletin

Error: Contact form not found.

Newsletter

Subscribe to our newsletter to get your Bi-monthly Newsletter:

India Blended Finance Bulletin

Error: Contact form not found.

Newsletter

Subscribe to our newsletter to get your Bi-monthly Newsletter:

India Blended Finance Bulletin