FAQs

FAQs

A frequently asked questions list is often used in articles, websites, email lists, and online forums where common questions tend to recur, for example through posts or queries by new users related to common knowledge gaps.

FAQs

Find answers to commonly asked questions about Blended Finance

FAQs

Find answers to commonly asked questions about Blended Finance

FAQs

Find answers to commonly asked questions about Blended Finance

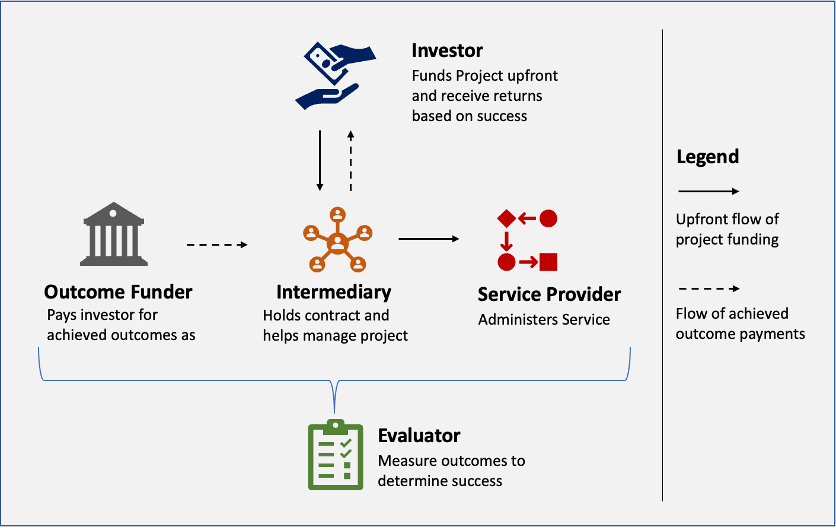

How Does Blended Finance Work?

Development and philanthropic funders use innovative financial structures to improve the risk-adjusted return profile of an investment, thereby making it more appealing to commercial investors.

Is Blended Finance similar to Impact Investing and ESG Investing?

No, Blended Finance is NOT a new investment discipline (nor an asset class) but an investment structuring approach.

What kind of organizations can utilise blended finance?

Any organisation that has a stake in the development ecosystem can benefit from blended finance. This includes individual donors, non-profits, for profit enterprises, social enterprises, foundations, commercial investors etc.

Is the process of raising capital via blended finance more complex than other methods?

At the moment, yes. The absence of standardized templates and unfamiliarity with such structures leads to the initial process taking longer than other methods. The continued education about blended finance and efforts towards making it mainstream are leading to a better understanding and appreciation of such structures by capital providers.

How do the motives of public, philanthropic and commercial sector funders differ?

Public and philanthropic actors strive to achieve more effective and lasting impact with their funding, while commercial sector capital providers need to aim either for a pre-defined financial return for a given (or perceived) risk, or less risk for a given expected return.

What incentives are available for each stakeholder participating in a blended finance structure?

The design process of the structure determines the degree of risk and incentive that each stakeholder has. Keep in mind that the design process is subject to negotiation based on the ability and appetite of the stakeholders involved to bear risks.

How can projects with small budgets and/or projects in nascent sectors support capacity building for NGOs and evidence creation?

To provide a better understanding, we shall use the example of the Bharat EdTech Initiative. Although EdTech is a large market, the ability of education non-profits to track and improve learning outcomes is not well established. This process could be improved using Pay for Results structures to generate new data and evidence on learning outcomes that can be leveraged by non-profits for their own programs.

Is Risk Guarantee or Insurance a recognizable product under CSR law?

Yes. Risk Guarantee is a recognizable product under CSR law.

What is the usually the median tenure of Pay for Results programs?

The typical time period is 4 to 5 years. It depends on the issue being solved and understanding of the duration it would take to generate measurable outcomes. In case of working capital requirements, it can be even shorter.