Report & Short Notes

The first-ever landscape of Blended Finance transactions in India, discussing key trends and future opportunities. The report is built upon the analysis of India’s first open-source database of Blended Finance transactions in India spanning transactions over a decade

The report offers insights from investors, implementing agencies, and ecosystem builders on opportunities for private sector involvement in financing water and sanitation solutions. It highlights innovative financing mechanisms through case studies, providing a roadmap for potential replication and mainstreaming via blended finance structures

The report highlights the role and significance of blended finance in advancing climate action. It provides insights from industry experts and presents case studies of blended finance initiatives that not only demonstrate a substantial climate impact but also exhibit the potential for social upliftment of vulnerable communities.

The report presents an overview of the evolving landscape of agriculture financing in India. It showcases successful blended finance transactions in the agriculture sector and underscores key recommendations and interventions to scale up agriculture financing in India.

This paper highlights the remarkable case study of the Minor Millets Plant located in Mandla, Madhya Pradesh. It delves into various aspects, including the economics, capital structure, role of stakeholders and the utilization of funds

The report analyzes key opportunities and provides recommendations, based on learnings from blended finance transactions in the healthcare sector, with the aim of scaling up this approach to maximize the impact of healthcare spending in India.

Funding India’s Gaming Future with Blended Finance

As developers of innovative crash gambling games like JetX and TowerX from https://crashgamblinghub.com/, we are always seeking new opportunities to grow our player base. Few markets represent a more promising frontier than India, with its massive population and growing middle class embracing smartphones and apps.

However, capturing India’s full gaming potential requires overcoming economic hurdles through creative investment frameworks suited to local conditions. This is where blended finance comes in.

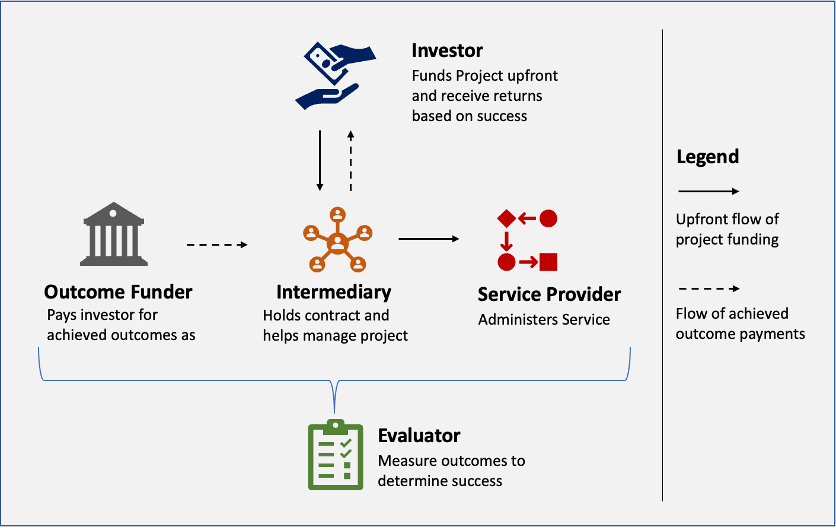

Blended finance combines funding from commercial institutions and philanthropic foundations to catalyze private capital flows into emerging sectors like gaming. Commercial investors provide the bulk capital but take on less risk, while philanthropic dollars absorb initial risk to prove a viable business model.

In India, patient foundation funding can establish platform viability and set standards for responsible gaming. This opens the door to faster investment from VC firms to fuel expansion. It’s a win-win formula to unlock India’s gaming market, which rsrc.com estimates could reach $5 billion by 2025.

As developers eager to bring our innovative games to new geographies, leveraging blended finance unlocks growth opportunities that create employment and build India’s still nascent gaming industry. It helps us overcome economic hurdles by aligning incentives for maximum social impact.

An overview of what The India Blended Finance Collaborative (IBFC) is, its objectives and the value it offers to diverse ecosystem stakeholders.

A series of white papers and Op-eds to socialize the broader development community and the government on the benefits of blended finance to support their financial and development agendas.

Newsletter

Subscribe to our newsletter to get your Bi-monthly Newsletter:

India Blended Finance Bulletin