Blended Finance helps smaller NBFCs achieve higher ratings, thereby unlocking previously inaccessible capital sources for them, which can be further passed on to MSMEs.

Blended Finance helps smaller NBFCs achieve higher ratings, thereby unlocking previously inaccessible capital sources for them, which can be further passed on to MSMEs.

India Blended Finance Collaborative (IBFC) is Impact Investor Council’s (IIC) pioneering initiative (supported by USAID) to help philanthropic and CSR capital maximize funding and social impact capacity through blended finance. As part of the IBFC, a series of masterclasses are planned in collaboration with partner organisations.

1. How and why is pay for results a powerful tool for social impact?

2. What are the different types of instruments under pay for results (DIB, SSN, performance-linked grant) and what roles do they serve?

3. Using real-life examples, demonstrate how we can flex these instruments to make them fit-for-purpose in terms of reducing costs and complexity and complying with CSR etc.

4. How can different types of donors (CSR, HNIs, Foundations) participate in pay-for-results based on return-impact matrix?

C-suit executives and leadership team members of philanthropic foundations, CSR teams, corporate foundations, impact investors, family offices, and others who are looking at innovative ways to increase the on-ground impact of their funding in a sustainable manner

The session would last 90 minutes in total, and the format includes two segments –

– 60 min MasterClass and Discussion with British Asian Trust on “How can we harness ‘pay-for-results’ as a powerful tool for social impact?”

– 30 min discussion with two funders of pay-for-results model on their learnings and experiences.

India Blended Finance Collaborative (IBFC) is Impact Investor Council’s (IIC) pioneering initiative (supported by USAID) to help philanthropic and CSR capital maximize funding and social impact capacity through blended finance.

1. How and why is Blended Finance a powerful tool for social impact

2. Understand the Blended Finance transaction lifecycle and how tailored approaches can be designed

3. How philanthropic and CSR capital can participate in blended finance under current regulatory frameworks

1. C-suite executives and leadership team members of philanthropic foundations, CSR teams, corporate foundations, family offices, and others.

2. Who are looking at innovative ways to increase the on-ground impact of their funding in a sustainable manner.

The session format includes a 120 minutes virtual/online webinar, followed by a Q&A segment. To keep the session interactive, the participation would be open to a limited audience.

Stay update-to-date about all the news pertaining to blended finance and contribute to shaping the future of blended finance in India.

Year & Duration:

2019 (9 years)

Sector:

WASH

Instrument:

Guarantees and insurance

USAID and USDFC partnered with a private bank to unlock credit for enterprises operating in water provision, water purification, toilet manufacturing, Fecal Sludge Management (FSM), etc. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 71 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

Private Bank

Vehicle Type:

Facility

Year & Duration:

2017 (5 years)

Sector:

Financial services

Instrument:

Guarantees and insurance

With this loan/bond, Northern Arc was the first financial institution in India to launch a partial guarantee product for Indian NBFCs. Under this structure, an entity issues NCDs or raises loans, which are backed by a partial guarantee as well as collateral (typically, in the form of a pool of loan assets), which the investor may access under certain situations.

Capital Commitment:

~USD 45 Mn over multiple issuances with over 20 originators

Sources of Capital:

Multiple financial institutions and banks in India, Northern Arc Capital

Vehicle Type:

Bonds/Notes

Year & Duration:

2018 (2 years)

Sector:

Financial services

Instrument:

Subordinate debt

Northern Arc structured and arranged the first PERSEC in India. PERSECs allowed monthly collections and prepayments in the underlying pool to be used to buy further receivables from the originator subject to a strict eligibility criterion and with provisions for early amortization if default rates reached a threshold level. This structure addressed the needs of FI clients who were looking for long-term financing and investors who were looking for better risk adjusted returns.

Capital Commitment:

~USD 95 Mn over multiple issuances

Sources of Capital:

DCB Bank, HLF, Northern Arc Capital

Stakeholders:

SK Finance, Aye Finance

Vehicle Type:

Bonds/Notes

Year & Duration:

2021 (4 years)

Sector:

Livelihoods

Instrument:

Guarantees and insurance

This is a pooled bond with 6 MFIs. Northern Arc provided 18-30% of guarantee cover to British International Investment (BII, formerly CDC).

Capital Commitment:

USD 43 Mn total portfolio with 18-30% guarantee cover

Sources of Capital:

British International Investment (formerly CDC), Northern Arc

Stakeholders:

MFIs: Annapurna, Arohan, Chaitanya, Asa, Fusion, Aashirvad

Vehicle Type:

Bonds/Notes

Year & Duration:

2022 (4 years)

Sector:

Livelihoods

Instrument:

Guarantees and insurance

WLB4Climate is the second investment of IIX’s Women’s Catalyst Fund, a next- generation gender-lens instrument that has partners including US International Development Finance Corporation (DFC), Korean International Cooperation Agency, and Australian Department of Foreign Affairs and Trade. WLB4Climate supports women-focused enterprises in India, Indonesia, Cambodia, and the Philippines, that are directly enabling women to create livelihoods to sustain themselves, their communities, and the planet, creating an ecosystem of climate-friendly small and medium-sized enterprises (SMEs).

Capital Commitment:

India Portfolio of USD 14 Mn with a guarantee

Sources of Capital:

IIX

Stakeholders:

Pahal, Kinara Capital

Vehicle Type:

Bonds/Notes

Year & Duration:

2019 (3 years)

Sector:

Education

Instrument:

DIB

This is a pioneering CSR-backed DIB, (IndusInd Bank and State Bank of India CSR) that fund a large project aimed at improving foundational language learning for 115,000 Class I and II students in 3,300 government schools across 7 districts in Haryana. The implementation partner for this program, the Language and Learning Foundation has expertise in carrying out literacy improvement programs by building the capacity of state officials (teachers, teacher educators, etc.) in partnership with state governments. CSF acted as the risk investor.

Capital Commitment:

Outcome funding of USD 2.2 Mn, risk capital of USD 0.45 Mn

Sources of Capital:

Central Square Foundation (CSF), IndusInd Bank, State Bank of India

Stakeholders:

Language Learning Foundation, HSSPP (Haryana School Shiksha Pariyojna Parishad), Social Finance India Education Outcomes (evaluator)

Vehicle Type:

Project

Year & Duration:

2021 (4 years)

Sector:

Livelihoods

Instrument:

DIB

Skill Impact Bond is an initiative of National Skill Development Corporation that is the risk investor with Dell Foundation. The bond will support 50,000 young people in India over 4 years, 60% of whom will be women and girls, and provide them with skills and training and access to wage- employment in COVID-19 recovery sectors including retail, apparel, healthcare, and logistics. CIFF, HSBC, JSW Foundation, and Dubai Cares are the outcome funders.

Capital Commitment:

Outcome funding of USD 17.7 Mn, risk capital of USD 4 Mn

Sources of Capital:

Dell Foundation, National Skill Development Corporation, CIFF, HSBC, JSW Foundation, Dubai Cares

Stakeholders:

British Asian Trust (BAT), USAID, Dalberg Advisors, Oxford Policy Management

Vehicle Type:

Project

Year & Duration:

2002 (15 years)

Sector:

WASH

Instrument:

Guarantees and insurance

WSPF – Tamil Nadu is a pooled bond to facilitate access to long-term domestic capital markets for small and medium urban local bodies (ULBs) to finance water and sanitation services. This enabled grouping of 13 ULBs to overcome high transaction costs and mobilize funds through a single bond issuance. Debt was repaid from project cash flows and general ULB revenues. A multi-layered credit enhancement package was designed in order to extend the maturity of the bond and increase investor confidence. The different credit enhancement mechanisms included a debt service reserve fund capitalized by the state government, creation of individual ULB escrow accounts, a local debt service reserve fund, a state revenue intercept mechanism, and a partial credit guarantee from USAID.

Capital Commitment:

Pooled bond issued by 13 municipalities; structured debt of USD 6.2 Mn with 9.2% coupon rate, 15- year maturity; AA rated

Sources of Capital:

Advanta Ltd, Baghat Urban Cooperative Bank Ltd, City Union Bank, Credit Capital Investments, Digital Globalsoft Ltd, Gujarat Industries Power

Vehicle Type:

Fund

Year & Duration:

2005 (15 years)

Sector:

WASH

Instrument:

Guarantees and insurance

KWSPF operates as a special purpose entity. The company was formed for the purpose of issuing debt securities to repay existing credit facilities, refinance indebtedness, and for acquisition purposes. KWSPF, issued a 15-year pooled bond to raise capital from domestic capital markets for small and medium ULBs. The fund specifically raised capital for a water supply and sewerage infrastructure development project in 8 ULBs within the Bangalore metropolitan area in Karnataka, India. USAID partial credit guarantee for 50% of the principal was an important feature of the transaction.

Capital Commitment:

Pooled issuance of ~USD 15 Mn; 50% partial guarantee; AA rated

Sources of Capital:

Government of India, private investors

Vehicle Type:

Project

Year & Duration:

2019 (9 years)

Sector:

WASH

Instrument:

Guarantees and insurance

USAID and USDFC partnered with an impact NBFC to unlock credit for enterprises operating in water provision, water purification, toilet manufacturing, Fecal Sludge Management (FSM), etc. USAID-USDFC provided partial pari-passu portfolio guarantee

Capital Commitment:

USD 10 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

NBFC

Vehicle Type:

Facility

Year & Duration:

2010 (11 years)

Sector:

Financial services

Instrument:

Subordinate debt, guarantees, and insurance

Northern Arc has facilitated over 100 transactions under the MOSEC structure for impact MFIs. In this structure, portfolios of multiple originators are pooled together and securitized. All MOSEC transactions feature double- layered downside protection for investors; first-loss tranches (~10%) provided by originators to respective microloans; and second-loss credit enhancement offered by Northern Arc via investment into the junior tranche or a guarantee. The first- loss cash reserve ensures that originators remain efficient and effective in their collection obligations. MOSEC structures have cumulatively mobilized ~USD 700 Mn in financing.

Capital Commitment:

USD 700-750 Mn over multiple issuances, 10 – 15% used as catalytic capital for first-loss tranche

Sources of Capital:

Commercial Banks, Northern Arc Capital

Vehicle Type:

Bonds/Notes

Year & Duration:

2019 (9 years)

Sector:

WASH

Instrument:

Guarantees and insurance

USAID and USDFC partnered with an impact NBFC to unlock credit for enterprises operating in water provision, water purification, toilet manufacturing, Fecal Sludge Management (FSM), etc. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 1 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

Svakarma

Vehicle Type:

Facility

Year & Duration:

2019 (9 years)

Sector:

Energy

Instrument:

Guarantees and insurance

USAID and USDFC partnered with a private bank to unlock credit for energy efficiency and renewable energy companies operating in the off-grid and distributed renewable energy sectors, including end users of all technologies.USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 75 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

Private Bank

Vehicle Type:

Facility

Year & Duration:

2021 (9 years)

Sector:

Agriculture

Instrument:

Guarantees and insurance

USAID and USDFC partnered with impact NBFCs to unlock credit for Farmer Producer Organizations (FPOs), ag-tech providers, and clean energy and food loss management solutions providers, exclusively for the development of solutions benefiting smallholder farmers. USAID-USDFC provided partial portfolio guarantee. Rabo Foundation will provide technical assistance funding to facilitate capacity building efforts for the borrowers.

Capital Commitment:

USD 37 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

NBFC

Vehicle Type:

Facility

Year & Duration:

2021 (9 years)

Sector:

Agriculture

Instrument:

Guarantees and insurance

USAID and USDFC partnered with impact NBFCs to unlock credit for Farmer Producer Organizations (FPOs), ag-tech providers, and clean energy and food loss management solutions providers, exclusively for the development of solutions benefiting smallholder farmers. USAID- USDFC provided partial portfolio guarantee. Rabo Foundation will provide technical assistance funding to facilitate capacity building efforts for the borrowers.

Capital Commitment:

USD 15 Mn with partial guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

NBFC

Vehicle Type:

Facility

Year & Duration:

2021 (9 years)

Sector:

Agriculture

Instrument:

Guarantees and insurance

USAID and USDFC partnered with impact NBFCs to unlock credit for Farmer Producer Organizations (FPOs), ag-tech providers, and clean energy and food loss management solutions providers, exclusively for the development of solutions benefiting smallholder farmers. USAID- USDFC provided partial portfolio guarantee. Rabo Foundation will provide technical assistance funding to facilitate capacity building efforts for the borrowers.

Capital Commitment:

USD 3 Mn with partial guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

NBFC

Vehicle Type:

Facility

Year & Duration:

2019 (9 years)

Sector:

Climate action

Instrument:

Guarantees and insurance

USAID and USDFC partnered with an impact NBFC to unlock credit for businesses operating in the forestry sector, including MSEs operating along sustainable forestry value chains, and/or to MFIs on-lending to such entities. Rabo Foundation participates as a first-loss guarantor. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 12 Mn with partial guarantee

Sources of Capital:

USAID, USDFC, Rabo Foundation

Stakeholders:

NBFC

Vehicle Type:

Facility

Year & Duration:

2019 (9 years)

Sector:

Climate action

Instrument:

Guarantees and insurance

USAID and USDFC partnered with an impact NBFC to unlock credit for businesses operating in the forestry sector, including MSEs operating along sustainable forestry value chains, and/or to MFIs on-lending to such entities. Rabo Foundation participates as a first-loss guarantor. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 3 Mn with partial guarantee

Sources of Capital:

USAID, USDFC

Rabo Foundation

Stakeholders:

NBFC

Vehicle Type:

Facility

Year & Duration:

2021 (7 years)

Sector:

Energy

Instrument:

Guarantees and insurance

USAID and USDFC partnered with two impact NBFCs to unlock credit for SMEs borrowing to invest in a rooftop solar system. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 43 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

NBFC

Vehicle Type:

Facility

Year & Duration:

2019 (9 years)

Sector:

Energy

Instrument:

Guarantees and insurance

USAID and USDFC partnered with an impact NBFC to unlock credit for SMEs operating in the renewable energy/energy efficiency sector, including SMEs in the manufacturing and non-manufacturing sectors that want to install a rooftop solar system. USAID- USDFC provided partial pari-passu portfolio guarantee

Capital Commitment:

USD 20 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

NBFC

Vehicle Type:

Facility

Year & Duration:

2014 (8 years)

Sector:

Financial services

Instrument:

Guarantees and insurance

Northern Arc launched India’s first pooled bond issuance program in 2014. Under this, loans or NCDs of multiple originators are housed within a single structure and backed by a common guarantee. The guarantee is typically in respect of an agreed percentage of the principal sums due under the loans or NCDs and may be invoked in case of a default by any client covered by the structure.This enables the originators to benefit from better pricing supported by a higher credit rating as well as widen their lender / investor base.

Capital Commitment:

~USD 450 Mn over multiple issuances with over 80 originators

Sources of Capital:

Multiple financial institutions and banks in India, Northern Arc Capital

Vehicle Type:

Bonds/Notes

Year & Duration:

2018 (5 years)

Sector:

Energy

Instrument:

Credit Line

The green climate fund provided a USD 100 Mn line of credit via NABARD for development of rooftop solar power in India’s commercial, industrial, and residential sectors. NABARD on-lent to Tata Cleantech (joint venture between Tata and IFC), an NBFC lending to rooftop solar projects. Another USD 100 Mn was put up by Tata Cleantech Capital, and USD 50 Mn by private investors/equity. The transaction had a total leverage of 1.5:1. The program proposed to replace 250 MW of grid power with power generated from solar rooftop projects.

Capital Commitment:

USD 250 Mn credit facility; USD 100 Mn concessional, USD 150 Mn commercial capital

Sources of Capital:

Tata Cleantech (TCCL), private investors, Green Climate Fund (GCF) via NABARD

Stakeholders:

Tata Clean Tech Capital Ltd

Vehicle Type:

Project

Year & Duration:

2018 (NA)

Sector:

Health

Instrument:

Guarantees and insurance

USAID and USDFC partnered with an NBFC to provide credit to Healthspring, a network of primary healthcare clinics, to assist in expansion of network. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 5 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

NBFC

Vehicle Type:

Company

Year & Duration:

2020 (2 years)

Sector:

Livelihoods

Instrument:

SSN / Interest Subvention

The bond provides credit facility to a non- profit, which provided livelihood support to women artisans that were unable to earn their daily wages amid the pandemic, to up-skill them with the vision of re- imagining their livelihoods in the aftermath of COVID-19.

Capital Commitment:

Bond of USD 0.07 Mn, with possibility of interest subvention

Sources of Capital:

Grameen Impact Investments Pvt Ltd

Stakeholders:

–

Vehicle Type:

Bonds / Notes

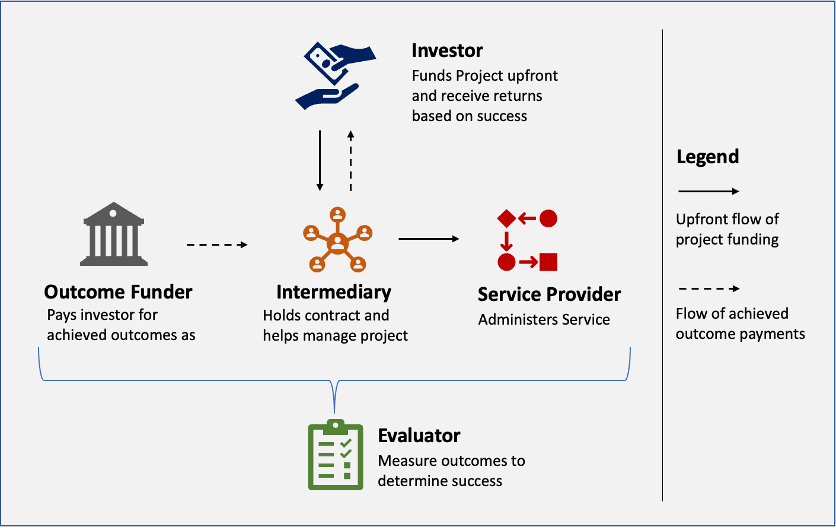

Results-based Financing is an innovative, outcomes-oriented or pay-for-success approach that incentivizes providers, and the investors providing their working capital, based on achievement of agreed- upon, measurable performance targets. Such structures are unique because capital is not deployed to satisfy the cost of inputs but to reward the achievement of desired outcomes by end beneficiaries. Common forms include Social/Development Impact Bonds, conditional cash transfers, debt swaps and outcome- linked interest rate loans.

Year & Duration:

2015 (3 years)

Sector:

Education

Instrument:

Development Impact Bond

This was the world’s first DIB in education. The DIB was implemented by Educate Girls in partnership with UBS Optimus Foundation (investor) and the Children’s Investment Fund Foundation (CIFF; outcome payer). The DIB was launched with the intention to scale Educate Girls’ impact, with a target to enroll and improve the quality of education for 15,000 girls in Rajasthan. The targeted outcomes were surpassed.

Capital Commitment:

Outcome funding of USD 0.42 Mn, risk capital of USD 0.27 Mn

Sources of Capital:

UBS Optimus Foundation, CIFF

Stakeholders:

Educate Girls, Instiglio (performance manager), IDinsight (evaluator)

Vehicle Type:

Project

Year & Duration:

2019 (2 years)

Sector:

Livelihoods

Instrument:

Social success note (SSN) / Interest subvention, guarantees, and insurance

Launched by Acumen and Grameen Impact Investments India Pvt Ltd, the bond provided INR 100 Mn credit facility to a pool of 5 for-profit skill development social enterprises to enable sustainable livelihoods for youth in rural and urban areas through vocational and skill development programs. The bond aimed to present a successful workable financial structure to private investors, corporates as well as the government to shift the credit facility assessment for such enterprises from being only a risk‐based assessment model to an impact‐based assessment model that can be incentivized.

Capital Commitment:

Bond of USD 1.3 Mn, supported by 100% guarantee

Sources of Capital:

Grameen Impact Investments India Pvt Ltd, Acumen

Stakeholders:

Social enterprises

Vehicle Type:

Bonds / Notes

Year & Duration:

2019 (2 years)

Sector:

Livelihoods

Instrument:

SSN / Interest subvention

The bond helped empower marginalized women by training them to become micro‐entrepreneurs and increase their incomes. Grameen Impact Investments structured the bond and committed INR 5 Mn as the upfront investment to the implementing agency (a Jaipur-based foundation) to deliver grass‐root impact within its communities of local women weavers. The intervention has the potential to promote a viable non‐farm livelihood option for socially excluded communities and marginalized women.

Capital Commitment:

Bond of USD 0.07 Mn, with possibility of interest subvention

Sources of Capital:

Grameen Impact Investments India Pvt Ltd

Stakeholders:

Domestic Foundations

Vehicle Type:

Bonds / Notes

Year & Duration:

2018 (2 years)

Sector:

Livelihoods

Instrument:

SSN / Interest subvention

Grameen Impact Investments committed INR 40 Mn (as the upfront investor) to ChildFund India (the implementing agency) with an objective of helping 2,000 marginalized tribal women in Maharashtra and Madhya Pradesh to become self- reliant and empowered by training them to become micro-entrepreneurs, with a specific outcome target of an average annual net income of ‐30,000 through this intervention. Grameen Impact had additionally taken on the role of identifying outcome funders for the bond.

Capital Commitment:

Bond of USD 0.53 Mn, with possibility of interest subvention

Sources of Capital:

Grameen Impact Investments India Pvt Ltd

Stakeholders:

ChildFund India

Vehicle Type:

Bonds / Notes

Year & Duration:

2019 (2 years)

Sector:

Energy

Instrument:

SSN / Interest subvention

Under this pioneering SDG #7 Impact Bond for clean energy, Grameen Impact Investments provided upfront financing to the implementation partner for implementing its Power@‐1 program at the Madras Diabetes Research Centre, Tamil Nadu.

Capital Commitment:

Bond of USD 0.07 Mn, with possibility of interest subvention

Sources of Capital:

Grameen Impact Investments India Pvt Ltd

Stakeholders:

Social enterprises

Vehicle Type:

Bonds / Notes

Year & Duration:

2020 (2 years)

Sector:

Agriculture

Instrument:

SSN / Interest subvention

This is India’s first domestically funded SDG bond for small and marginal farmers. Through this, Grameen Impact had provided a credit facility to private sector foundations with the aim of scaling their impactful, scalable, and sustainable community-owned Lead Farmer Platform to address gaps in last-mile delivery of agriculture extension services and significantly contribute toward increasing the income of small and marginal farmers.

Capital Commitment:

Bond of USD 2.6 Mn, with possibility of interest subvention

Sources of Capital:

Grameen Impact Investments India Pvt Ltd

Stakeholders:

–

Vehicle Type:

Bonds / Notes

Year & Duration:

2021 (2 years)

Sector:

Agriculture

Instrument:

SSN / Interest Subvention

The bond was launched to empower smallholder and marginal farmers with the goal of increasing their incomes and helping them adopt sustainable agricultural farming practices.

Capital Commitment:

Bond of USD 1.5 Mn, with possibility of interest subvention

Sources of Capital:

Grameen Impact Investments Pvt Ltd

Stakeholders:

–

Vehicle Type:

Bonds / Notes

Year & Duration:

2020 (2 years)

Sector:

Others

Instrument:

Returnable grant

Blended finance facility and livelihood accelerator. REVIVE, in collaboration with companies, foundations, and social organizations, identifies deserving informal sector workers and micro-entrepreneurs who have been affected by the pandemic, and provides holistic support to aid their recovery, build their resilience, and invest in their long-term growth. REVIVE provides financial assistance in the form of standard, returnable grants. A returnable grant is the first of its kind – it is funding that comes with zero interest for the beneficiary. It is structured such that repayment only begins once the individual starts earning and is financially stable. The money is then used to fund another individual in need, and so on.

Capital Commitment:

USD 20 Mn facility

Sources of Capital:

Avanti Finance, Svakarma, Gromor- DeAsra, Arth Anchor funders: USAID, Dell Foundation, Omidyar Network India, British High Commission, United Nations Development Programme

Philanthropic funders: Godrej, S&P Global, Brihati Foundation, Vinati Organics, Microsoft, LinkedIn, IIFL, Google, Kotak Mahindra Bank, HDFC Capital, HSBC, Arvind, Info Edge

Stakeholders:

Pratham, Dhriiti, Vrutti, Ambuja Cement Foundation, Mann Deshi Foundation, SEWA, Haqdarshak, Atpar, TRRAIN, Tisser, Snapbizz, Mswipe, Learnet, UMC

Managed by: Samhita Social Ventures, Collective Good Initiative

Vehicle Type:

Facility

Year & Duration:

2018 (7 years)

Sector:

Energy

Instrument:

Guarantees, insurance, and TA grant / grant

Sindicatum Renewable Energy Company issued the first international local currency green bond in South Asia with a maturity of 7 years. The bond issuance proceeds will finance three brownfield renewable energy projects in India. The bond is listed on the London Stock Exchange. GuarantCo provided a full guarantee for the bond issue. This guarantee helped the bond attain A1 rating from Moody’s and AA- from Fitch. A technical assistance (TA) facility was also provided to cover the legal costs associated with the pioneering issuance. The two bonds are due in 2023 and 2025.

Capital Commitment:

2 INR denominated bonds of IN R 951 Mn and INR 1,585 Mn, listed on the London Stock Exchange, with full guarantee

Sources of Capital:

Public markets GuarantCo, Private Infrastructure Development Group (PIDG)

Stakeholders:

–

Vehicle Type:

Bonds / Notes

Year & Duration:

2014 (3 years)

Sector:

Others

Instrument:

TA grant / Grant, credit line

The IIX ACTS project is a blended funding model that provides customized investment readiness TA support to impact enterprises, prioritizing early growth-stage enterprises whose majority of beneficiaries and stakeholders are women. The eligible enterprises receive TA upon 10% upfront cost payment and repay the remaining loan as they scale. The program focuses on five sectors – agriculture, health, education, energy, and water – across the Asia- Pacific region.

Capital Commitment:

Total facility of USD 19 Mn, with 10% for TA; India share unknown

Sources of Capital:

Bank of America Charitable Foundation, JP Morgan Chase Foundation, The Rockefeller Foundation, USAID

Stakeholders:

13 social enterprises

Vehicle Type:

Facility

Year & Duration:

2012 (10 years)

Sector:

Financial services

Instrument:

Subordinate debt, TA grant/grant

MIFA is the first microfinance initiative of its size to exclusively target Asian MFIs. MIFA targets Tier II and III MFIs to achieve deep outreach in its target markets by creating and enhancing institutional capacity for sustainable microfinance delivery and to strengthen links between domestic and international capital markets. The International Finance Corporation (IFC) and KfW were the initiators and helped catalyze private funding. BMZ (German Federal Ministry of Economic Cooperation and Development) also provides a TA facility.

Capital Commitment:

NAV of USD 130 Mn, with 31% of assets under management in India

Sources of Capital:

BMZ (German Federal Ministry of Economic Cooperation and Development), EU, IFC, KfW

Stakeholders:

BlueOrchard Finance

Vehicle Type:

Fund

Year & Duration:

2020 (4 years)

Sector:

Livelihoods

Instrument:

Guarantees and insurance

This is the world’s first gender-lens impact investment security listed on a stock exchange. This innovative instrument mobilizes private capital from all over the world for financing financial institutions (FIs) and impact enterprises focused on creating sustainable livelihoods for women. The WLB bond series pool high-impact women-focused enterprises to create a multi-country, multi-sector, and multi-stakeholder portfolio and issue bonds through a special purpose vehicle (SPV) based in Singapore. These bonds are sold via IIX’s investment banking partners to international accredited and institutional investors, and the proceeds are lent to underlying entities. In India, IIX has partnered with Kinara and Centrum. The loan proceeds will be onward lent to finance and support 2,500+ women- owned small businesses.

Capital Commitment:

Portfolio of USD 12.5 Mn, with a guarantee

Sources of Capital:

WLB Asset II B Pvt Ltd

Stakeholders:

Kinara, IIX, Singapore, (portfolio manager), Visage Holdings and Finance Pvt Ltd, and WLB Asset II B Pvt Ltd

Vehicle Type:

Bonds/Notes

Year & Duration:

2017 (4 years)

Sector:

Education

Instrument:

SSN/ Interest subvention, TA grant/grant

The Michael & Susan Dell Foundation designed and developed a pay-for- performance instrument with Varthana, to lend to the affordable private school (APS) segment and drive learning outcomes. The objective was to use financial incentives to nudge school owners to prioritize quality learning. The Dell Foundation offered Varthana an NCD with a mix of commercial and concessional capital. Varthana then mobilized smaller loans to 337 schools across 11 cities in India. The foundation further incentivized the schools with a rebate on interest rate linked to improvement in learning outcomes. A TA was also provided to Varthana to build capacity in these schools to understand and assess learning outcomes.

Capital Commitment:

USD 6 Mn commercial debt USD 2 Mn concessional debt, ~USD 1 Mn TA

Sources of Capital:

Michael & Susan Dell Foundation

Stakeholders:

Varthana, Grey Matters Capital (evaluator)

Vehicle Type:

Bonds/Notes

Year & Duration:

2018 (4 years)

Sector:

Education

Instrument:

DIB, TA grant/ grant

The DIB supported Indian education providers improve learning outcomes for primary school children through an innovative results-based funding mechanism. The DIB aims to achieve this goal by funding three high-performing service providers to improve grade- appropriate learning outcomes for more than 300,000 primary school children aged 5-11 years. Pay-for-performance mechanism aims to maximize education outcomes at scale.

Capital Commitment:

Outcome funding of USD 9.2 Mn, risk capital of USD 3 Mn

Sources of Capital:

UBS Optimus Foundation

Stakeholders:

Gyan Shala, Kaivalya Education Foundation, Society for All Round Development, Pratham Infotech Foundation, Dalberg (performance manager), Grey Matters Capital (evaluator), Go Labs, Brooking – (Research)

Vehicle Type:

Project

Year & Duration:

2018 (3 years)

Sector:

Health

Instrument:

DIB, TA grant/grant

This is the world’s first health DIB, with the UBS Optimus Foundation as the investor, and MSD for Mothers and the United States Agency for International Development (USAID) as the outcome funder. It aims to improve the quality of maternal care in Rajasthan’s private health facilities by supporting up to 440 small healthcare organizations to meet the new government quality standards and adhere to them over the long term. Payments are made when the private facilities are verifiably ready for NABH and Manyata certification.

Capital Commitment:

Outcome funding of USD 8 Mn, risk capital of USD 2.9 Mn

Sources of Capital:

UBS Optimus Foundation, MSD for Mothers, USAID

Stakeholders:

HLFPPT (Hindustan Latex Family Planning Promotion Trust)/ PSI (Population Services International), Palladium, Mathematica Policy Research (independent evaluator), Social Finance UK, Reed Smith, Phoenix Legal

Vehicle Type:

Project

Year & Duration:

2015 (2 years)

Sector:

Education

Instrument:

SSN / Interest subvention

ISFC provides schools, especially those with limited access to credit, with financial resources to improve infrastructure and quality of education offered. The financing mechanism linked learning outcomes to financial incentives for APSs. The foundation provided debt to ISFC, which provided 3-6-year loans to APS at variable interests. After 2 years, an end-line assessment was conducted. If the school meets its pre- determined targets, it can realize interest rate rebates on the loan amount and the reward payment is adjusted in accordance with ISFC’s interest payments to the foundation (i.e., the foundation absorbs the cost of the reward only when there is a demonstrated achievement of learning targets), while the principal gets repaid fully.

Capital Commitment:

Debt of USD 1.57, with possible interest subvention up to 3.5%

Sources of Capital:

Dell Foundation

Stakeholders:

Gray Matters India (evaluator)

Vehicle Type:

Project

Year & Duration:

2020 (5 years)

Sector:

Financial services

Instrument:

Guarantees and insurance

The guarantee aims to unlock on-lending credit of at least INR 1,500 Mn (USD 20 Mn) for micro-enterprises, and impact at least 10,000-15,000 micro-entrepreneurs and their employees. Caspian Impact Investments is a non-banking financial company (NBFC) that offers loans to companies focusing on financial inclusion and to social enterprises in the areas of agriculture, education, healthcare, and energy. Up to 20% of loans are covered by the partial risk guarantee provided by the Dell Foundation.

Capital Commitment:

USD 20 Mn credit facility, with partial risk guarantee support

Sources of Capital:

Dell Foundation

Stakeholders:

Caspian Debt

Vehicle Type:

Company

Year & Duration:

2018 (NA)

Sector:

Health

Instrument:

Guarantees and insurance

USAID and USDFC partnered with an NBFC to provide credit to Healthspring, a network of primary healthcare clinics, to assist in expansion of network. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 5 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

NBFC

Vehicle Type:

Company

Year & Duration:

2021 (2 years)

Sector:

Financial services

Instrument:

Guarantees and insurance

USAID and USDFC partnered with a private bank to unlock credit for mid-market (non-AAA rated) NBFCs for on-lending to MSMEs with gender inclusive practices and policies and to MSMEs operating in sectors impacted by COVID-19. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 50 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

Private Bank

Vehicle Type:

Facility

Year & Duration:

2022 (5 years)

Sector:

Climate action

Instrument:

Guarantees and insurance

The Climate Smart Fund for onward lending by an NBFC was partially guaranteed by an International Foundation. This enabled the NBFC to extend loans to enterprises including agri-SMEs, agritech businesses, clean technology companies working with renewable energy, climate adaption, climate mitigation, climate resilience technologies in agriculture supply chain which include support the following: (i) renewable energy in agriculture, (ii) regenerative agriculture, or (iii) circular use in agriculture.

The names of the NBFC and Foundation have been kept confidential on request.

Capital Commitment:

USD 3.6 Mn catalyzed by a partial guarantee

Sources of Capital:

Confidential

Stakeholders:

Confidential

Vehicle Type:

Facility

Year & Duration:

2022 (3 years)

Sector:

Health, Livelihood

Instrument:

Guarantees and insurance, SSN

The objective of the transaction is to generate livelihoods for beneficiaries from vulnerable communities, through skilling. IIT Delhi (SAMRIDH Hosting entity) through its research and development deployed a new and innovative financing solution to enable skilling and placement through implementing entity in partnership with the National Skill Development Corporation (NSDC) and 360 ONE Foundation thereby exponentially impacting 3 to 4x beneficiaries in comparison to training using vanilla grant. This financing solution enables the implementing entity to offer short-term training and placement to beneficiaries, either through fee-based or government-sponsored model schemes.

The project is divided into two phases:

Phase 1 (Training): The project leverages 360 ONE Foundation’s grant of INR 1.335 Cr to unlock additional working capital loan of INR 4.00 Cr from NSDC at an affordable rate of 6% p.a. through partial risk guarantee to train and place 2420 beneficiaries (3 to 4x beneficiaries in comparison to training using vanilla grant) and provide employment opportunities and livelihood linkages to them. The guarantee is renewable for two years. If the risk guarantee is not invoked or is partially invoked, it will be utilized to further enable working capital loan, thereby training additional beneficiaries. In case the guarantee is not invoked within the first two years, the balance amount will be utilized in the form of a vanilla grant in the third year to directly fund training of more beneficiaries.

Phase 2 (Placement & Retention): On achievement of an additional milestone ie beneficiaries are retained in the job after 3 months post placement, a component of 360 ONE Foundation’s grant amounting to INR 26.70 lakhs will be used in the form of Social Success Note linked to placement and retention of beneficiaries thus leading to further reduction in cost of borrowing for the implementing entity and incentivizing the risk investor (NSDC) for better performance outcomes.

This initiative is compliant with CSR regulations under clause (ix) (b) of Schedule VII of the Companies Act, 2013 – contribution to public funded universities like IITs to engage in conducting research aimed at promoting Sustainable Development Goals (SDGs). To ensure compliance with the CSR mandate, IIT Delhi pays out the grant to NSDC and provides utilisation evidence. Further, the end outcome of training and placement of marginalised marginalised beneficiaries is monitored and reported at regular intervals. Also the grant is tracked for a period of 2 years so that any balance is utilised as further support to end beneficiaries.

Capital Commitment:

Mobilized additional USD 0.5 mn using ~30% partial risk guarantee; USD 0.04Mn as interest-linked incentives

Sources of Capital:

360 ONE Foundation, NSDC

Stakeholders:

IPE Global, IIT Delhi, Implementing Entity undertaking training, 360 ONE Foundation

Vehicle Type:

Facility

Year & Duration:

2021 (1 year)

Sector:

Financial Services

Instrument:

Guarantees and insurance

CIIE.CO is the Innovation Continuum built at IIM Ahmedabad spreads across incubation, acceleration, seed and growth funding, and research. CIIE.CO has partnered with 360 ONE Foundation to address the issue of lack of accessible and quality credit for the Bharat Segment, which comprises Indian households living on less than $10 a day. With the support from 360 ONE Foundation, CIIE.CO was able to provide three inclusive lending start-ups with catalytic funding support of INR 40,00,000 to be utilized as a First Loss Default Guarantee (FLDG) capital, and one start-up with a funding support of INR 45,00,000 for validation grant. The catalytic funding support enabled the start-ups to unlock significant additional capital (>10X leverage) from formal credit sources to validate their business case and extend the benefits of financial inclusion and access to credit to the Bharat Segment. Under the project, CIIE.CO also provided technical assistance and business progression support to the selected start-ups over a period of 8 months.

From a CSR compliance perspective, CIIE.CO has Section 12A Income Tax Exemption, 80G and a CSR Certificate. Contribution to CIIE.CO is in line with Schedule VII item list ix (a) of Companies Act. To ensure compliance with the CSR mandate, CIIE.CO paid out the grant to start ups and provided utilisation evidence. Further, the impact of financial assistance on end beneficiaries is monitored and reported at regular intervals.

Capital Commitment:

Mobilised ~ USD 1.7Mn as loans using ~USD 0.25Mn as grant as first loss tranche

Sources of Capital:

360 ONE Foundation, NBFCs

Stakeholders:

CIIE.CO, 360 ONE Foundation

Vehicle Type:

Project

Year & Duration:

2018 (11 years)

Sector:

Energy

Instrument:

Concessional Equity, TA

The GGEF, anchored by India’s National Investment and Infrastructure Fund (NIIF) and the UK Foreign, Commonwealth and Development Office (FCDO), and managed by EverSource (Mumbai), is a fund-of-funds structure that has raised US$741 million from a mix of institutional investors and DFIs, supported by concessional funds in the form of subordinated equity from the GCF (via Dutch development bank FMO). GGEF is one of the largest single-country funds focused on Climate change, Mitigation and Adaptation in the emerging markets. GGEF plans to invest equity capital through sectoral platforms in climate technology growth firms in renewable energy, e-mobility, energy services and resource efficiency projects with strong innovation potential.

Capital Commitment:

Mobilised USD 741 Mn using concessional equity and TA

Sources of Capital:

FCDO, NIIF, Green Climate Fund

Stakeholders:

BP (British Petroleum), Allianaz, BII, FMO, Microsoft, Triodos, Royal Bank of Carribean

Vehicle Type:

Fund

Year & Duration:

2013 (5 years)

Sector:

Livelihoods

Instrument:

Concessional Equity, TA

FCDO and SIDBI anchored one of the first social venture funds ‘Samridhi Fund’ to provide risk capital to scalable enterprises that benefit the poor in the low-income states through job creation, increased earnings and reduced cost of goods and services. Alongside, FCDO also provided TA support to the Fund – to strengthen social impact monitoring and measurement, improve ESG standards of investees, overall capacity building etc.

More details at: https://devtracker.fcdo.gov.uk/projects/GB-1-114293/summary

Capital Commitment:

Mobilised USD 65 Mn using concessional equity and TA

Sources of Capital:

FCDO, SIDBI

Stakeholders:

SIDBI Venure Capital

Vehicle Type:

Fund

Year & Duration:

2023 (4 years)

Sector:

Livelihoods

Instrument:

Guarantees and insurance

The US$50 million IIX Women’s Livelihood Bond 5 is the first sustainable debt security in the market issued in compliance with the Orange Bond Principles and is expected to empower ~300,000 women and girls across Asia and Africa. The proceeds of the WLB5 will be used to make loans to high-impact enterprises in Cambodia, India, Indonesia, Kenya, and the Philippines that operate across six sectors: microfinance, SME lending, clean energy, sustainable agriculture, water and sanitation, and affordable housing.

Capital Commitment:

India portfolio of USD 22 Mn

Sources of Capital:

IIX

Stakeholders:

Northen Arc

Vehicle Type:

Bonds / Notes

Year & Duration:

2022 (1 year)

Sector:

Financial Services

Instrument:

Subordinate Debt

The PTC structure allowed the Consumer Finance Company to reach underserved and new to credit customers and offer credit at better rates compared to informal money lenders. It also helped beneficiaries cover emergency needs. Northern Arc took a subordinate role to offer increased protection to the investor.

Capital Commitment:

~USD 28 Mn catalyzed with first loss tranche

Sources of Capital:

Northern Arc

Stakeholders:

Consumer Finance Company, Commercial Bank

Vehicle Type:

Bonds / Notes

Year & Duration:

2022 (3 years)

Sector:

Financial Services

Instrument:

Subordinate Debt

The PTC structure allowed the Consumer Finance Company to reach underserved and new to credit customers and offer credit at better rates compared to informal money lenders. It also helped beneficiaries cover emergency needs. Northern Arc took a subordinate role to offer increased protection to the investor.

Capital Commitment:

~USD 33 Mn catalyzed with first loss tranche

Sources of Capital:

Northern Arc

Stakeholders:

Consumer Finance Company, Commercial Bank

Vehicle Type:

Bonds / Notes

Year & Duration:

2020 (4 years)

Sector:

Agriculture

Instrument:

Guarantees and insurance

The loan guarantee facility was used to unlock credit for early stage enterprises engaged in impact sectors. Philanthropic capital of upto USD 85K was used as as a first loss tranche.

Capital Commitment:

USD 0.26 Mn mobilized with a first loss tranche of USD 0.085 Mn

Sources of Capital:

Caspian Impact Investments Pvt Ltd, The Lemelson Foundation

Stakeholders:

IQ EQ Corporate Services (Mauritius (this is backed by IIEF -Impact Innovators and Entrepreneurs Foundation)

Vehicle Type:

Facility

Year & Duration:

2022 (5 years)

Sector:

Agriculture

Instrument:

Guarantees and insurance

The NBFC received a credit guarantee by an International Foundation for lending to women entrepreneurs, women farmers or women-led enterprises in upstream agri-value chains such as Farmer Producer Organizations / Community Based Organizations, agri-SMEs and agritech businesses.

Additionally, lending to the above entities that are in upstream agri value chains working with renewable energy/climate adaption/mitigation/resilience technologies which provide following: (i) renewable energy in agriculture, (ii) regenerative agriculture, or (iii) circular use in agriculture. (DRE, RE, afforestation, organic cultivation, circular use of commodity)

The guarantee is to enable the NBFC to create a portfolio of INR 900 Mn on a revolving basis for 5 years.

The names of the NBFC and Foundation have been kept confidential on request.

Capital Commitment:

USD 11.25 Mn catalyzed by a partial guarantee

Sources of Capital:

Confidential

Stakeholders:

Confidential

Vehicle Type:

Company

Year & Duration:

2015 (5 years)

Sector:

Livelihoods

Instrument:

Guarantees and Insurance

In India, Citi had a USD 10 Mn loan facility, partially guaranteed by Overseas Private Investment Corporation, with Ujjivan Financial Services, a microfinance institution (MFI) that provides microloans to India’s female urban microentrepreneurs. This facility enables women entrepreneurs to avail loans to grow their businesses, hire employees, and promote economic progress for themselves, their families, and communities.

Capital Commitment:

USD 10 Mn loan facility with partial guarantee

Sources of Capital:

Citibank, Ujjivan Financial Services, Overseas Private Investment Corporation

Stakeholders:

–

Vehicle Type:

Facility

Year & Duration:

2022 (1 year)

Sector:

Health

Instrument:

SSN / Interest Subvention

To strengthen India’s healthcare system, Axis Bank Samridh Blended Finance Facility has introduced a Portfolio level- Performance linked payment structure (Incentives worth ~2.50% p.a. interest on loans upon achievement of target milestones) to enable access to commercial capital for small and medium-scale enterprises within the healthcare sector. This pay-for-success blended finance instrument will help for-profit enterprises by enabling access to affordable capital for scaling their operations and creating social impact. In this model, the commercial capital provider offers concessionary capital to the small, or medium-sized enterprise that has a proven business model, and the outcome funder provides incentives in the form of interest subvention to the qualifying healthcare enterprises when they achieve the pre-defined target impact milestones, thereby improving their risk-return profiles. making capital more affordable. The impact outcomes shortlisted for the healthcare enterprise are quantifiable and easily measurable for the model to succeed and scale up.

Capital Commitment:

USD 157 Mn with up to 2.5% p.a. interest subvention; 2.48mn philanthropic capital from USAID (SAMRIDH)

Sources of Capital:

Axis Bank, USAID (SAMRIDH)

Stakeholders:

IPE Global

Vehicle Type:

Facility

Year & Duration:

2022 (1 year)

Sector:

Financial Services

Instrument:

Cocessional Debt, Guarantees and Insurance

The Labour Dignity Bond was set up to provide low cost working capital loans to micro-contractors in the urban construction space as an incentive to adopt and mantain ethical practices.

The transaction involved a lending partner NBFC – Gromor Finance, entity through which the working capital loans were extended. KOIS India led the financing structuring of the project. Gromor issued NCDs to KOIS Holdings and the received $265k in return to lend to micro-contractors.

The loan portfolio by backed by an FLDG of 35% each, by MSDF and Acumen Foundation. The facility was set up as a working capital line (avg. ticket size of 3-5 lacs), for 90 days at the rate of interest of 18% annually which is much lower compared to 23-24% interest rates that the borrowers avail otherwise via informal channels.

Under working capital facility, underwriting was conducted for ~120 micro-contractors, out of which 22 MCs passed the process and had an option to avail the loan. Additional incentives provided to micro-contractors include work orders, entrepreneurship training and ethically sourced workers.

Capital Commitment:

USD 0.27Mn with a guarantee of upto 70%

Sources of Capital:

KOIS, Acumen, MSDF

Stakeholders:

NORAD, GFEMS – TA grant provider; Sattva Consulting, Haqdarshak, Gromor Finance

Vehicle Type:

Facility

Year & Duration:

2020 (2 years)

Sector:

Livelihoods

Instrument:

Guarantees and insurance

This is a grant to support financing of micro-entrepreneurs in the construction sector, with FLDG covering ~20% of loan amount.

Capital Commitment:

Total fundraise of USD 1 Mn +

Sources of Capital:

Dell Foundation, other funders

Stakeholders:

Sattva, Sambhav Foundation

Vehicle Type:

Company

Year & Duration:

2021 (2 years)

Sector:

Financial services

Instrument:

Guarantees and insurance

USAID and USDFC partnered with a private bank to unlock credit for SMEs, with a focus on those that are women-owned or with women loan signatories, and where women are the primary decision-makers. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 100 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

Private Bank

Vehicle Type:

Facility

Year & Duration:

2020 (3 years)

Sector:

Health

Instrument:

Guarantees and insurance

The guarantee from USAID covers 50% pari-passu risk on principal only on the qualifying loans extended by the bank to the healthcare entities by paying a utilization fee to the USAID every year on the outstanding loan book. There is significant need for medium- to long-term financing for healthcare en risk-sharing guarantee of losses after collection efforts pursuant to the claim. In case of recovery, the bank shall reimburse USAID on a pro-rata basis the recovered funds after deducting any expenses incurred in the collection efforts.terprises in India. The guarantee is a pro-rata risk-sharing guarantee of losses after collection efforts pursuant to the claim. In case of recovery, the bank shall reimburse USAID on a pro-rata basis the recovered funds after deducting any expenses incurred in the collection efforts.

Capital Commitment:

USD 50 Mn facility with 50% pari-passu partial guarantee

Sources of Capital:

IndusInd Bank, USAID

Vehicle Type:

Facility

Year & Duration:

2015 (8 years)

Sector:

Financial services

Instrument:

Guarantees and insurance

USAID and USDFC partnered with impact NBFCs to unlock credit for enterprises operating in the education, financial inclusion, food and agriculture, healthcare, water, sanitation and hygiene, renewable energy and energy efficiency sectors. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 35 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

NBFC

Vehicle Type:

Facility

Year & Duration:

2015 (8 years)

Sector:

Financial services

Instrument:

Guarantees and insurance

USAID and USDFC partnered with impact NBFCs to unlock credit for enterprises operating in the education, financial inclusion, food and agriculture, healthcare, water, sanitation and hygiene, renewable energy and energy efficiency sectors. USAID-USDFC provided partial pari-passu portfolio guarantee.

Capital Commitment:

USD 10 Mn with 50% pari-passu guarantee

Sources of Capital:

USAID, USDFC

Stakeholders:

NBFC

Vehicle Type:

Facility

Year & Duration:

2017 (5 years)

Sector:

Energy

Instrument:

TA grant / Grant

USICEF is India’s first project preparation facility to scale up distributed solar power projects and develop them into viable investment opportunities and drive long- term debt financing. Grant-funded TA helped prepare high-quality investment- grade project proposals to increase prospects of obtaining long-term debt financing. So far, the grantees have been able to mobilize cumulative USD 300 Mn of commercial capital in long-term financing.

Capital Commitment:

USD 20 Mn facility

Sources of Capital:

CDC, Grantham Foundation, Government of India

Stakeholders:

Climate Policy Initiative

Vehicle Type:

Facility

Year & Duration:

2020 (7 years)

Sector:

Financial services

Instrument:

Subordinate Debt

This is a 6-year blended finance vehicle structured as an alternate investment fund (AIF). The fund utilizes a layered capital structure with subordinate catalytic risk funding (~20% of the committed capital) from impact foundations, high net-worth individuals (HNIs) and the Vivriti Group being used to crowd in senior commercialinvestors for financial inclusion. Fund invests INR 0.15–0.25 billion per transaction in capital market instruments like NCDs issued by NBFCs and other lenders that extend last-mile finance to micro-entrepreneurs and low-income households. The tenure of instruments ranges from 2-6 years. This helps the NBFCs to develop a capital market footprint in addition to directing capital to areas where is it most needed. The fund is India’s first AIF to have a senior tranche rated AA+ (SO) for capital protection by CRISIL. The fund has received USD 3 Mn in commitments from the Dell Foundation.

Capital Commitment:

USD 35 Mn fund

Sources of Capital:

Dell Foundation, banks, insurance companies, HNIs, Vivriti Group

Stakeholders:

MFIs, SMEs, Vivriti Asset Management Pvt Ltd.

Vehicle Type:

Fund

Year & Duration:

2005 (17 years)

Sector:

WASH

Instrument:

TA grant / Grant

Under this program, Water.org provides grants, TA, and educational resources to MFIs for them to scale up sanitation loans to households. The objective is to expand access to clear drinking water and sanitation infrastructure in India. WaterCredit helps bring small loans to those who need access to affordable financing and expert resources to make household water and toilet solutions a reality.

Capital Commitment:

USD 855 Mn mobilized

Sources of Capital:

IDFC First, IndusInd Bank, Unity SFB, Satin, Muthoot, Cashpor, Annapurna

Stakeholders:

TA/ Grant providers: PepsiCo Foundation, Caterpillar Foundation, SwissRe Foundation, Microsoft AWS, Cummins Bank of America, Ikea Foundation, Target, USAID

Vehicle Type:

Facility

Year & Duration:

2020 (3 years)

Sector:

Health

Instrument:

TA grant / Grant

Supported by USAID and implemented by IPE Global, SAMRIDH unlocks affordable capital through blended finance structures to scale high-impact and commercially sustainable solutions targeted to improve healthcare for vulnerable communities. It is structured as a multi-sectoral partnership, with the Government of India, development agencies, private sector, including entrepreneurs, accelerators, and financial institutions, and academia. SAMRIDH has mobilized a capital pool of USD 350+ million to offer both grant and debt financing provided to healthcare enterprises, with a target to achieve leverage of 8–10x on its investments. Through this approach over 60+ high-impact solutions have been funded reaching over 30 Million population.

Capital Commitment:

Mobilized USD 350 Mn using ~USD 25-30 Mn concessional capital

Sources of Capital:

USAID

Stakeholders:

IPE Global

Vehicle Type:

Facility

Year & Duration:

2021 (2 years)

Sector:

Health

Instrument:

SSN / Interest subvention

Multiple social enterprises with proven business models are covered under an umbrella of low-cost loans under this program. Caspian Debt provided loans to healthcare enterprises in the pool using which the enterprise will work to achieve pre-agreed social impact outcomes. Based on the achievement of these outcomes, they will receive an outcome payment (from SAMRIDH) via Caspian Debt equivalent to 5% p.a. of the interest payment, thereby reducing the overall interest cost for the enterprises. Each of the social enterprises which form part of the portfolio have to achieve quantifiable and measurable impact indicators basis which the quantum of outcome payments is linked.

Capital Commitment:

USD 5 Mn facility, with up to 5% p.a. interest subvention

Sources of Capital:

Caspian Debt, USAID (SAMRIDH)

Stakeholders:

IPE Global

Vehicle Type:

Facility

Year & Duration:

2020 (3 years)

Sector:

Health

Instrument:

Returnable grant, guarantee and insurance, interest subvention

Blackfrog Technologies is a health- tech company specializing in the last- mil biologicals. Its groundbreaking invention, EMVÓLIO, a portable, active cooling, battery-powered device, facilitates safe last-mile delivery of COVID-19 vaccines across the country. Through the blended finance structure, Blackfrog was able to avail a loan from Caspian Debt, a leadinge delivery of medical supplies and NBFC. However, given the risk profile of the enterprise additional collateral was required to avail the loan as well as initial support to service the loan at market rates until entity achieves commercial sustainability. Blackfrog was also provided with scale-up advisory support through the TA facility of USAID to enable access to international markets such as Africa.

Capital Commitment:

Total investment of USD 0.2 Mn

Sources of Capital:

Caspian Debt USAID, Rockefeller Foundation

Stakeholders:

IPE Global

Vehicle Type:

Facility

Year & Duration:

2013 (2 years)

Sector:

Financial services

Instrument:

Guarantees and insurance

Rabo provided 100% guarantee cover, to one of the largest FPOs in India to enable their access to credit.

Capital Commitment:

USD 0.07 Mn with full guarantee

Sources of Capital:

NBFCs

Stakeholders:

FPOs

Vehicle Type:

Facility

Year & Duration:

2020 (3 years)

Sector:

Financial services

Instrument:

Guarantees and insurance

Rabo Foundation provided a partial portfolio guarantee with Nabkisan to FPOs, federations, agri SMEs, agtech companies, etc.

Capital Commitment:

USD 3.7 Mn with partial guarantee

Sources of Capital:

Nabkisan

Stakeholders:

Secondary FPOs, federations, agri SMEs, agtech companies, mature FPOs

Vehicle Type:

Facility

Year & Duration:

2020 (3 years)

Sector:

Financial services

Instrument:

Guarantees and insurance

This is a guarantee support for on- lending to micro and small enterprises. The guarantee enables NBFCs to raise capital to create a liquidity fund focused on providing loans to micro entrepreneurs impacted by the COVID-19 pandemic in India.

Capital Commitment:

Total fund of USD 5.6 Mn

Sources of Capital:

International foundation, private investors

Stakeholders:

–

Vehicle Type:

Fund

Year & Duration:

2018 (4 years)

Sector:

Agriculture

Instrument:

Guarantees and insurance

Rabo Foundation provided a partial guarantee to 4 leading banks for financing FPOs for post-harvest requirements.

Capital Commitment:

USD 2.7 Mn with partial guarantee

Sources of Capital:

Private Banks

Stakeholders:

FPOs

Vehicle Type:

Facility

Year & Duration:

2020 (3 years)

Sector:

Agriculture

Instrument:

Guarantees and insurance

Rabo Foundation partnered up with a small NBFC to provide a portfolio guarantee for lending to agtech companies.

Capital Commitment:

USD 2 Mn with partial guarantee

Sources of Capital:

NBFC

Stakeholders:

Agtech startups

Vehicle Type:

Facility

Year & Duration:

2019 (2 years)

Sector:

Agriculture

Instrument:

Guarantees and insurance

Impact NBFC received a credit guarantee from Rabo Foundation for strengthening its ability to provide loans to FPOs, cooperatives, Self-Help Groups (SHGs), and other community-based organizations with appropriate credit products, and facilitate access to finance to such organizations. The guarantee enabled impact NBFC to create a portfolio of INR 240 Mn.

Capital Commitment:

USD 3.2 Mn with partial guarantee

Sources of Capital:

Impact NBFC

Stakeholders:

Early stage FPOs

Vehicle Type:

Facility

Year & Duration:

2019 (3 years)

Sector:

Agriculture

Instrument:

Guarantees and insurance

Rabo Foundation partnered up with a mid-size NBFCs to provide a portfolio guarantee for lending to agtech companies.

Capital Commitment:

USD 2 Mn with partial guarantee

Sources of Capital:

NBFC

Stakeholders:

Agtech startups

Vehicle Type:

Facility

Year & Duration:

2022 (3 years)

Sector:

Financial services

Instrument:

Subordinate debt

This is a 3-year blended finance vehicle structured as an AIF. The fund utilizes a layered capital structure with 75% senior tranche, 17.5% mezzanine tranche, and 7.5% subordinate tranche. This structure allows investors with different risk-return preferences to co-exist in the same fund. The senior tranche is being anchored by an Indian Development Finance Institution (DFI) with a mandate to develop India’s MSME sector. Fund invests NCDs issued by NBFCs and other lenders that extend last-mile finance to MSMEs, micro-entrepreneurs, and low-income households, to help the borrowing entities develop a capital market footprint.

Capital Commitment:

USD 40 Mn fund

Stakeholders:

Vivriti Asset Management Pvt Ltd

Vehicle Type:

Fund

Year & Duration:

2021 (7 years)

Sector:

Agriculture

Instrument:

Guarantees and insurance

Samunnati received a credit guarantee from the USDFC to create a portfolio of USD 25 Mn (nearly INR 200 Cr) with a 50% pari-passu credit guarantee from the DFC. It is focused on FPOs where a majority of the underlying members are women and agtech companies providing key technology solutions to small and marginal Farmers (SMFs), clean energy solutions companies, and companies engaged in food loss management solutions for SMFs.

Capital Commitment:

USD 25 Mn fund, with 50% guarantee

Sources of Capital:

USDFC

Stakeholders:

Samunnati Finance

Vehicle Type:

Fund

Year & Duration:

2014 (NA)

Sector:

Energy

Instrument:

Concessional capital

SolarArise is an Indian SPV facility that invests in grid-connected solar PV assets and projects in India, engaging in both acquisitions of existing power stations and developing Greenfield solar fields.Investment strategy of SolarArise prioritizes low-risk assets that can provide annuity-like payments to its investors and offer short- term investment cycles. SolarArise received concessional capital from GEEREF.

Capital Commitment:

Total fundraise of USD 100 Mn; USD 13 Mn from GEEREF

Sources of Capital:

GEEREF (Global Energy Efficiency and Renewable Energy Fund), Thomas Lloyd Group, Core Infrastructure India Fund

Stakeholders:

–

Vehicle Type:

Company

Year & Duration:

2011 (NA)

Sector:

WASH

Instrument:

Concessional capital

The project provides safe drinking water that is purified at the point of sale through a low-cost chlorination technique and using a local distribution system based on existing water kiosks. The project focuses on providing clean water to rural villages in Eastern India.

Capital Commitment:

Total capital of USD 0.7 Mn

Sources of Capital:

Confidential

Stakeholders:

–

Vehicle Type:

Company

Year & Duration:

2020 (NA)

Sector:

Financial services

Instrument:

Subordinate debt

An Indian fintech company raised a Series C round using concessional capital from a DFI, which helped catalyze private sector participation.

Capital Commitment:

Total fundraise of USD 11 Mn

Sources of Capital:

DFI, private equity fund

Stakeholders:

–

Vehicle Type:

Company